Chen Xi, Chen Haopeng, Zheng Qing, Wang Wenting, Liu Guodong

Detailed Poster: download

Overview

A number of challenges in implementing cloud technique related to further improving Web application performance and decreasing the cost. In order to achieve high profits, cloud-based web application providers must carefully balance cloud resources and dynamic workloads. However, this task is usually difficulty because of the complex nature of most web application. The volume of demand in applications fluctuates on several times scales. Therefore, performance model must be effectively adjustable to workloads in order to support next step scheduling. We presented a predictive performance model to analyze such applications and to determine when and how much resource to allocate to each tier of an application. In addition, we proposed a new profit model to describe revenues specified by the Service Level Agreement (SLA) and costs generated by leased resources. Furthermore, we employed profit driven model to guide our resource management algorithms to maximize the profits earned to the service provider. We also designed and implemented a simulation experiment on CloudSim that adopts our proposed methodology. Experimental results indicated that our model faithfully captures the performance and resources are allocated properly in response to the changing workload, thus the goal of maximizing the profit has been achieved.

Problem Statement

- Workload Prediction

The capacity manager is required in the framework as for adjusting allocation of VMs for future demand. More specifically, we want to predict the demand curves in the time one period for SaaS provider, where the current time and the next predictive point can be denoted. We deploy auto-regressive (AR) mode to predict the expected demand curve, experimentally, we use linear AR model provided by MATLAB to obtain the predictive demand in next interval.

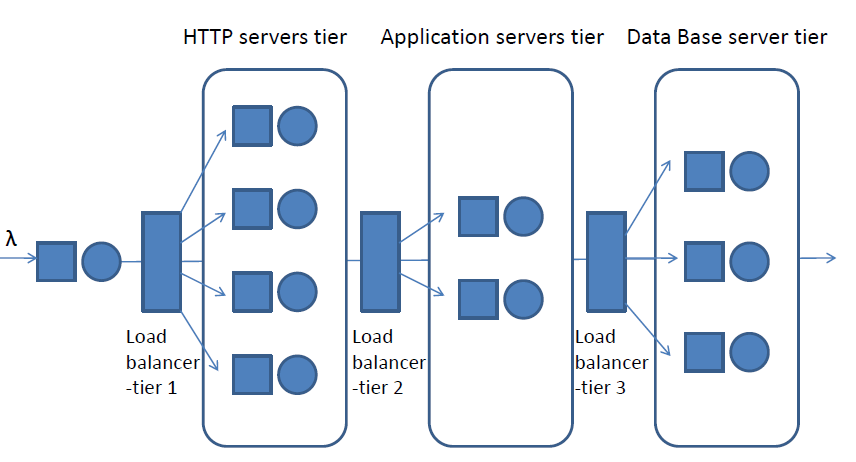

Figure1. Performance Model

Figure1. Performance Model

- Performance Prediction

- Profit-driven scheduling policy

The resource pool is modeled by a queuing network composed of a set of multi-class single-VMs queue as shown in Fig. 1.

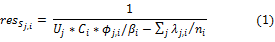

The application environment under study is a resource pool consisting of m class of heterogeneous VM. We extend this residence time to Equation 4 by adding terms representing system characteristics as follow:

A user request is supported by multi-tier web applications. We apply our control schemes and solve the profit optimization for independent tiers. When confronted with different kinds of service, each VM distribute its own computing resource in accordance with the ratio of service rate. The estimated CPU service rate of a service managed by tier i is given by:

Finding the ideal regression method for this problem is over the scope of this paper, and one can choose a regression method from a variety of known methods in the literature. In our system, the object of for regression method is to minimize the variance:  where k is the index of monitoring window over time. Then, this set of

where k is the index of monitoring window over time. Then, this set of  can be solved in order to estimate the parameter of different service in different tiers. After this step, the approximated response time of next monitoring window is computed from the predicted workload and estimated

can be solved in order to estimate the parameter of different service in different tiers. After this step, the approximated response time of next monitoring window is computed from the predicted workload and estimated .

.

In Figure 2, Marginal Revenue (MR) and the Marginal Cost (MC) are two critical factors we need to account for in this problem.

The maximization of profit is when MR=MC at point A.

Figure2. Profit-driven Scheduling Policy

Figure2. Profit-driven Scheduling Policy

Simulation and Experiment

To evaluate the effectiveness of the proposed approach, we have designed and implemented a prototype of our framework using CloudSim, a toolkit for modeling and simulation of Cloud computing infrastructures and services. The simulation data consisted of 20 VMs on homogenous physical nodes on the first place. In the simulation, each node is modeled to have one CPU core with performance of 3000 MIPS, 8 Gb of RAM and I TB storage, and each VMs has 512 Mb of RAM, the same as the physical machine in our lab for the purpose of processing physical environments in the future. Table 1 shows all parameters of our simulation.

Table.1 CloudSim Simulation Parameter Settings| Simulation Parameters | Value |

|---|---|

| Initial number of VMs | 5 |

| VM cost | 0.3$ |

| VM per Memory | 0.05$ |

| VM per Storage | 0.1$ |

| VM per Bandwidth | 0.1$ |

| Small service revenue function |  |

| Middle service revenue function |  |

| Large service revenue function |  |

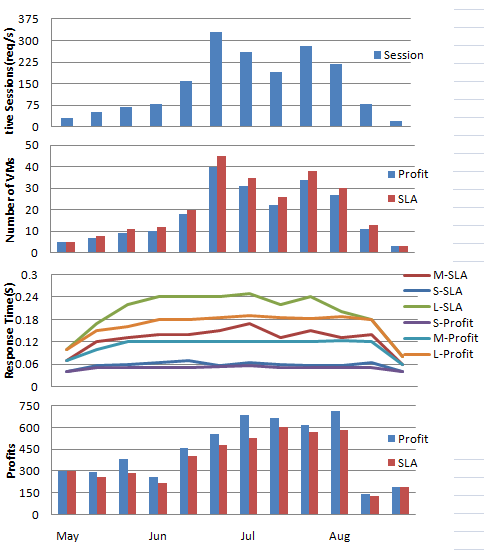

We repeated these two experiments by using our profit-driven provisioning technique and QoS-driven. Our results are shown in Figure 3.

Firgue 3. Two Scheduler Evaluation: QoS-driven Policy and Profit-driven Policy

Firgue 3. Two Scheduler Evaluation: QoS-driven Policy and Profit-driven PolicyFrom the top to bottom: input workload (a), number of VMs needed in two policies (b), response time of different services (c), profit obtained in two policies (d).

The entire results obtained from our simulation are summarized in Table 2. Our results demonstrated that Service provider and Cloud resource provide can both be profitable through profit-driven provisioning technique by less number of VMs and 15.37% profit increased. Also, because that our provisioning technique is able to take profits imposed by revenue and cost as priority, it can also maintain a relatively acceptable response time targets by adding more VMs when profits do not reach the max at this workload.

Table 2. Overall Comparative Results| Algorithm | Avg. Response Time (%) | Total Revenue | Total Cost | Total Profit |

|---|---|---|---|---|

| Profit | 84.1% | 15650.0 | 10396.6 | 5253.4(15.37%) |

| SLA | 100% | 17200.7 | 12663.3 | 4537.4 |